In the world of pension planning, the question “Can I afford to retire?“, or the closely related “When can I afford to retire?“, is probably the most frequently asked.

And understandably so.

If I asked you “When would you like to retire?” what would your answer be?

Now.

In 5 years’ time.

5 years ago!

The truth is that the vast majority of us would like to retire sooner rather than later. Be that a desire to enjoy a long and happy retirement or just to escape the rat race.

So, what’s stopping you?

That’s right. You don’t know if you can afford to. And you are not alone …

Research shows that 77% of people do not know how much they need in retirement.

Let’s find out what the answer is …

1. Can I Afford To Retire? The Answer

It depends!

I know, that’s a cop-out answer and you knew that I was going to say it.

The thing is, the answer is specific to you.

Think about it – would the answer be the same for a single mum working for minimum wage and for Elon Musk? (For those who have been living under a rock for the last decade or so, Elon Musk is currently the world’s richest man according to Forbes).

It all comes down to finding your personal Magic Number.

2. Your Pension Magic Number

So, what is your pension magic number?

Your pension magic number is the size of the pension fund you want to have at your chosen retirement date.

To work out what the figure is you need to:

- Estimate what your living expenses will be in retirement

- Estimate how long you are likely to be in retirement

- Calculate the pension fund needed to meet the requirements for 1 and 2

2.1 Retirement living expenses

So, how do you establish what your living expenses are likely to be in retirement?

Well, I’ll put forward 3 options for your consideration:

2.1.1 Centre for Research in Social Policy

Loughborough University’s Centre for Research in Social Policy released a report in October 2021 in which they outlined the funds needed for 3 categories of retirement lifestyle.

| Minimum | Moderate | Comfortable | |

|---|---|---|---|

| Single person | £10,900 | £20,800 | £33,600 |

| Couple | £16,700 | £30,600 | £49,700 |

The lifestyle categories are fairly broad but are described as follows:

- Minimum

Covers all your needs, with some left over for fun.

For example, 1 holiday per year in the UK - Moderate

More financial security and flexibility.

For example, 1 foreign holiday each year. - Comfortable

More financial freedom and some luxuries.

For example, 2 foreign holidays per year.

2.1.2 Which?

The consumer magazine Which? conducted its own research among its retired members.

Of course, it could be argued that retirees who are also Which? members are not representative of the population as a whole. However, I think the key point is that it gives you further examples of the figures you may wish to aim at.

The Which? Survey also included 3 lifestyle categories. The results were as follows:

| Essential | Comfortable | Luxury | |

|---|---|---|---|

| Single person | £12,000 | £19,000 | £31,000 |

| Couple | £18,000 | £28,000 | £45,000 |

You’ll note that the figures from the 2 surveys are very similar. This is, to my mind, a good thing as it suggests that the estimate are reasonably accurate.

2.1.3 Do It Yourself

Now, whilst these are very useful examples, the most accurate approach is to make a budget that applies to your specific circumstances.

I would suggest that you keep a record of your expenditure (ideally for a full year so that everything is covered).

And then ‘flex’ it to account for costs that are likely to fall in retirement (eg mortgage, commuting costs) and those that will rise (eg utility costs due to being at home more).

However, do not use this data-gathering exercise as an excuse to defer making any pension provisions for a year! Pick one of the categories from the 2 surveys for now and then amend it once you have your own data.

2.2 Retirement duration

OK, so we know how much we are likely to be spending in retirement. The next thing to do is to estimate how long we will be incurring these expenses.

That’s right – pension planning necessitates accepting the fact that you won’t live forever!

In establishing the duration we need 2 pieces of information:

- A start point (when your retirement begins)

- An end point (when you shuffle off this mortal coil)

The former you can determine with precision as you will choose it. The latter you can only influence, not ultimately determine!

Data from the Office for National Statistics suggests that although life expectancy in the UK has increased over the last 40 years there was a slight drop in 2020 as a result of the coronavirus pandemic.

The figures showed life expectancy in females was 82.9 years and in males, it was 79. The figures also showed that the average age at death was 85.8 years for females and 82.3 years for males.

The ONS has a Life Expectancy Calculator.

It shows that a 55-year-old man has:

- An average life expectancy of 84

- A 1 in 4 chance of reaching 92

- A 1 in 10 chance of reaching 97

- And a 3.8% chance of hitting 100!

Data from the Centers for Disease Control and Prevention (CDC) in the USA indicates a life expectancy of 77.0 years as of 2020.

So, armed with that information, you can see that if you retire at 65 you will have roughly 20 years of retirement expenses to finance.

Similarly, retire at 55 and its 30 years of expenses or retire at 75 and its 10 years of expenses.

2.3 Pension fund requirement

We now know the estimated annual cost of living in retirement and how long we are likely to be in retirement.

Next step – what size pension fund will we need in order to meet this outlay?

Historically, before pension flexibility in the UK, holders of pension funds would buy an annuity at retirement.

Basically, you pay a life company the whole of your pension fund in return for a guaranteed income for the rest of your life. If you die the day after then it’s a good day for the life company! Not so much if you live for the next 40 years.

I advise you to go on living solely to enrage those who are paying your annuities. It is the only pleasure I have left.

Voltaire

Annuities are still available and may be attractive to some investors. However, the decline in annuity rates, their charges, and increased pension flexibility means that many now choose to retain their pension funds and draw down on them.

Things to consider in relation to income drawdown include:

- Pension fund growth rate

- Pension fund charges

- Inflation

- Other sources of income

According to The Telegraph, the average UK pension fund stands at £61,897.

However, if you are looking for a comfortable after-tax income of £28,000 per annum as a couple (the mid-band estimates from section 2.1 above) then you would need a fund of £204,750 if buying an annuity or £144,950 if using income drawdown.

And this is after allowing for each member of the couple to receive around £9,500 in State Pension income.

And how should this fund be accumulated? …

3. Personal Pensions

There are a number of ways that you can make provision for your retirement magic number.

However, the most efficient for most people will be a personal pension.

Why?

There are 2 main reasons:

- Tax relief

- Employer contributions

These both represent free money into your fund!

3.1 Personal Pensions – Tax Relief

Within limits (see below) UK individuals can get tax relief on their personal pension contributions. So, how does this work?

If you are a Basic Rate (20%) taxpayer and you contribute £800 the Government will add a further £200. This is automatically claimed for you by the pension scheme provider. So, £1,000 in your pension fund only costs you £800.

If you are a Higher Rate (40%) taxpayer and you contribute £800 then again a further £200 will be added to your pension fund in the form of tax relief. In addition, you can complete a tax return and claim a further £200. Meaning that £1,000 in your pension fund only costs you £600.

Similarly, for an Additional Rate (45%) taxpayer that £1,000 in your pension fund only costs you £550.

So, using personal pensions enables you to get tax relief on contributions. Surely it can’t get any better than that, can it?

Yes. Yes, it can!

You see, in addition to tax relief on the way in, you also get tax relief on the way out! When you extract funds from your personal pension 25% of it is not classed as taxable income.

Now, there are limits to this personal pension enhancement of your retirement funds – the Government wants to encourage individuals to save for their retirement but doesn’t want the cost to be too great for them.

That said, for the vast majority, the limits are unlikely to be of concern:

- Annual Allowance

There is an annual cap on the maximum contribution level. For the current (2022/23) tax year it is £40,000 (or 100% of your earnings if less than £40,000).

For high earners, the Annual Allowance is tapered – down to £10,000 once earnings exceed £300,000.

Unused amounts may be carried forward for up to 3 years. - Lifetime Allowance

There is a charge if your pension funds exceed the Lifetime Allowance.

In the current tax year, this stands at £1,073,100.

3.2 Personal Pensions – Employer Contributions

Employer pension schemes have been around for many years. However, this was only for some employers and some employees.

Now, in the UK, there is a requirement for all employers to provide a workplace pension – commonly referred to as “Automatic Enrolment“.

If the qualifying conditions are met then your employer MUST:

- Automatically enrol you into a pension scheme

- Make contributions to the scheme on your behalf

From April 2019 onwards, workplace pension scheme contributions are as follows:

- Employer contribution 3%

- Employee contribution 5%

- Total 8%

So, that’s 3% of your salary going into your pension for nothing – more free money.

3.3 Personal Pensions – Other Considerations

3.3.1 Compounding Returns

Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.

Albert Einstein

The principle of compounding returns applies to pension funds too.

If you are 21 years old and putting only £50 per month into a pension you may wonder whether it is worth it.

It is!

In the future, your fund doesn’t just grow from your further contributions, it grows from the growth in the funds that you have already contributed. And from the reinvestment of any income generated by the funds (eg dividends).

Consider this:

- Your fund is worth £1,000 in year 1

- 10% growth adds £100

- In year 2 the growth is now on £1,100 (giving £110 if we stick with 10%)

- In year 3 it is on £1,210 (giving £121)

- And so on, and so on

Now, clearly, compounding works even over the very short period in the example above – but imagine the effect over 35 years!

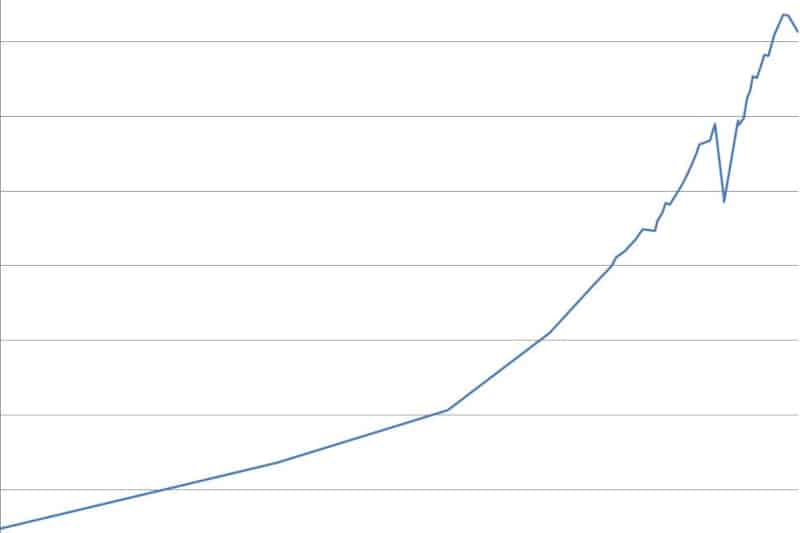

Take a look at the graph below showing the growth in pension funds for me and my wife. Note how the growth started slow and then accelerated.

Some things to note:

- We started our pensions when we were 21

- We were only contributing 2% of our salary at the time

- But our employer put in 4% (free money!)

- As our careers progressed we increased our contributions

- Our contributions attracted tax relief (more free money!)

- Any income (dividends) was reinvested

- Spot the impact of the coronavirus pandemic!

The sooner you start your pension fund contributions, the sooner it will benefit from the effect of compounding returns.

Even if you are relatively young and can only make the minimum 5% contribution to a workplace pension scheme – do it! You get 2 lots of free money (tax relief and employer contributions) and give your scheme time to grow from the effect of compounding returns.

3.3.2 Salary Sacrifice

We’ve seen how much free money we can get in the form of tax relief on pension contributions.

What if I told you that you could get relief for National Insurance Contributions too?

So far, we’ve considered the scenario where you make contributions to your personal pension scheme and receive tax relief for doing so.

But what if your employer made those contributions instead?

Obviously, they would want you to agree to a reduction in salary in return – but what about the NIC that they would normally pay on that sacrificed salary?

Well, they are under no obligation to do so but, if you discuss it with them, many employers will add the saved NIC to the contribution that they make to your pension scheme.

They do this because it is at no extra cost to them – see below for a simplified example.

| Standard | Sacrifice | |

|---|---|---|

| Cost to employer | ||

| Salary amount | £1,000.00 | £0.00 |

| Employer NIC @ 15.05% | £150.50 | £0.00 |

| Pension contribution | £0.00 | £1,150.50 |

| Total | £1,150.50 | £1,150.50 |

| Employee pension | ||

| Pension contribution | £800.00 | |

| Pension scheme tax relief | £200.00 | |

| Employer contribution | £1,150.50 | |

| Total | £1,000.00 | £1,150.50 |

4. State Pension

So, in addition to paying Income Tax on your earnings throughout your working life, you will also have paid National Insurance Contributions (NIC).

The amount of NIC paid will determine the amount of the State Pension that you receive.

For the current tax year (2022/23) the maximum State Pension is £185.15 per week (£9,628 per annum).

The age at which the State Pension can be taken is constantly under review (which is Government-speak for gradually increasing the age so that they don’t have to pay out as much!).

For many years the State Pension age was 65 for everybody. However, this is gradually being increased. For some, it will now be 66, for others 67, and it is set to increase to 68 for those retiring after 2044.

To find your State Pension Age you can use the Government calculator.

If you are unsure of your NIC payment history, and therefore the amount of State Pension that you will receive, you can get a forecast here: State Pension forecast.

5. Case Studies

Let’s take a look at a couple of scenarios to see how this all fits together.

Case Study 1 – Sheldon

Sheldon is 21 years old, has a salary of £20,000, and has no existing pension provision.

He is a member of his employer’s workplace pension scheme through the Auto-Enrolment provisions. So, he contributes 5% and his employer contributes 3%.

| Detail | Amount |

|---|---|

| Sheldon’s net contribution | £800 |

| Tax relief claimed by the pension scheme | £200 |

| 5% Gross contribution by Sheldon (£20,000 x 5% = £1,000) | £1,000 |

| 3% Employer contribution | £600 |

| 8% Total contribution | £1,600 |

This will provide Sheldon with a pension fund at a State Pension Age of 68 of £126,000.

This should give Sheldon an annual income of £5,680. When combined with the State Pension this should give an annual income of £20,800.

These are gross (pre-tax) figures.

After deducting tax from the income (and allowing for the 25% tax-free element) this would put him between the Minimum and Moderate categories in the calculations by the Centre for Research in Social Policy.

Case Study 2 – Leonard and Penny

Leonard is 25 years old, has a salary of £35,000, and has £10,000 of existing pension provisions.

Penny is 30 years old, has a salary of £40,000, and has £25,000 of existing pension provisions.

They both belong to their employer’s workplace pension scheme through the Auto-Enrolment provisions. So, they contribute 5% and their employers contribute 3%.

| Detail | Leonard | Penny |

|---|---|---|

| Net contribution | £1,400 | £1,600 |

| Tax relief claimed by the pension scheme | £350 | £400 |

| 5% Gross contribution | £1,750 | £2,000 |

| 3% Employer contribution | £1,050 | £1,200 |

| 8% Total contribution | £2,800 | £3,200 |

This will provide Leonard with a pension fund at a State Pension Age of 68 of £209,000. Penny’s fund would be £224,000.

This should give Leonard an annual income of £9,560. When combined with the State Pension this should give an annual income of £24,100.

Penny’s figures would be £10,400 and £24,200 respectively.

As a couple, this gives them a gross income of £48,300.

After allowing for tax, this would put them between the Moderate and Comfortable categories in the calculations by the Centre for Research in Social Policy.

All calculations were prepared using the excellent Hargreaves Lansdown Pension Calculator.

6. FAQ

What is the 4% rule in relation to pension drawdown?

The 4% rule is a very general guideline that says that if you draw the same amount (4%) from your pension fund annually, as adjusted for inflation, then the fund will last for the whole of your retirement (estimated at 30 years or more and retiring at 65).

Many advisers feel that 4% is too cautious and that 5% would be more realistic. Others feel that there should be more caution and a 3% rate used.

How much money do you need to retire comfortably in the UK?

Often referred to as the Pension Magic Number, the amount needed in your pension to fund your retirement is a result of 2 factors:

1. The length of your planned retirement

2. The anticipated expenses that you will incur in retirement

Organisations such as the Centre for Research in Social Policy and consumer magazine Which? have put forward broad lifestyle categories to assist with planning for your Magic Number (Minimum, Moderate, and Comfortable). For example, to achieve a comfortable after-tax income of £28,000 pa as a couple you would need a fund of £204,750 if buying an annuity or £144,950 is using income drawdown.

Do early retires live longer?

If you retire early then you have the opportunity to sleep better/longer, exercise more, devote more time to dietary considerations, avoid stressful work situations (potentially causing high blood pressure), and even arrange visits to health professionals more promptly.

And several studies have shown that stopping work early can have health benefits and extend your life expectancy. A 2018 study in the US found that 7 years of retirement can reduce the chances of getting a serious health condition (eg heart disease) by as much as 20%.

How long does the average person live after they retire?

Life companies employ teams of actuaries to ponder this very question. It all comes down to age, gender, and lifestyle. And probabilities.

A Boeing study (now disputed) found that employees retiring at 55 lived, on average, until they were in their mid-80s but those retiring at 65 only lived for another 18 months post-retirement.

Is it worth working after retirement?

Working part-time after retirement can be beneficial both in terms of having additional funds and also in terms of social contact (some retirees miss the social contact with work colleagues and customers).

In fact, some retirees who do not need the additional income choose to do volunteer work so that they can increase their social contact while helping a worthy cause.

7. Conclusion

I hope that the information above has proved useful and that you are now in a better position to be able to answer the question “Can I Afford to Retire?“.

If you can’t afford to retire then don’t despair, look at what you can do to improve your retirement outlook.

If you can afford to retire, may I suggest that you read some of the other posts on the site to help you on your way to a happy retirement?

Wow, this is a very informative and helpful post. I like the way you introduce us to the topic and how you broke everything down. I think it’s very hard for most people to think about numbers and estimate costs. I do believe nonetheless this can be changed through financial education and this is a great piece for that matter! I’m bookmarking this to reread and come back to it. Very thoughtful and practical. Thank you!

Hi Vanessa. Thank you for your positive feedback. I know that many people have a complete blindspot when it comes to finances so if I can help, I will 🙂

This is a really informative post with lots to consider. I pay into a pension but definitely know there is more savings I can do. As I don’t want to rely on a state pension. Thank you for sharing this information.

Lauren

Thanks for your comment, Lauren, I’m glad that you found the post to be informative. I’m glad that you have started your pension planning – just remember to review the situation periodically.

Great questions and the answers make sense. I will keep them in mind for future reference.

Hi. Thanks very much for your feedback – I’m glad that the answers made sense.

quite the informative and insightful read about retirement. thanks for sharing.

Hey. I’m glad that you enjoyed the post – thanks for your comment.

This is a really helpful post packed full of useful information. Whilst I’m a long way off retiring, my dad recently has and he definitely had to factor in a lot of things before he could come to his decision.

Thanks, Kelly, I’m glad that you found it helpful. Don’t let the fact that you are a long way off retiring stop you from planning ahead 😉