Why should you care about how to live on a tight budget?

Well, there is no escaping it – we are in extremely challenging financial times. And many of us are going to be a lot worse off as a result.

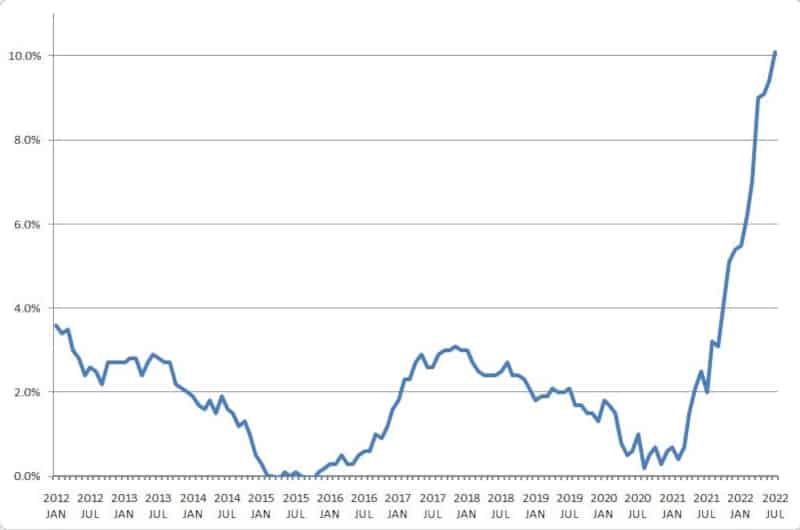

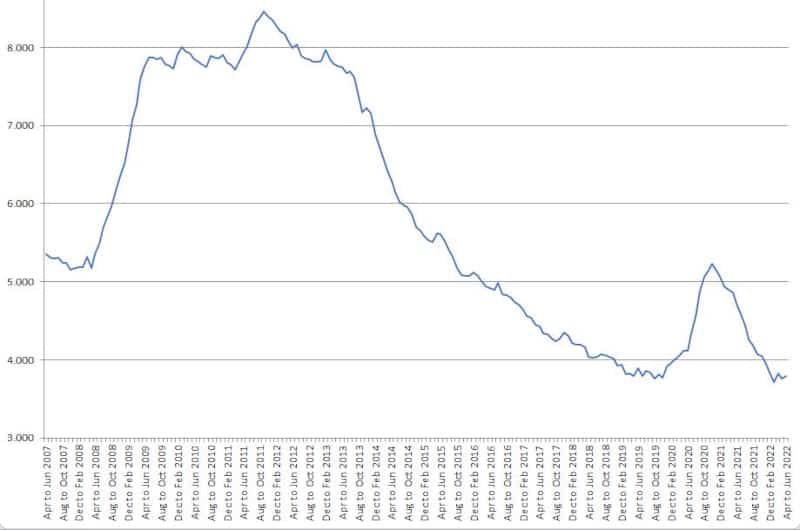

Double-digit inflation and its impact on the cost of living.

The rocketing energy price cap and the prospect of being forced to choose between paying to heat or paying to eat.

(EDIT: Following the appointment of Liz Truss as PM in the UK there will be a temporary freeze on the energy price cap – £2,500 for the next 2 years.)

So, what’s the answer?

Analysing your income and expenditure, and making spending decisions based on that analysis, otherwise known as making a budget, could just be the help that you need to survive these trying times – and beyond

In the sections that follow we’ll look at how to create your own budget and what steps you may be able to take to help improve your financial situation.

Let’s take that first step …

Just a heads up: This post contains affiliate links – purchases you make through these links may generate a small commission for me, at no extra cost to you.

1. How to Live on a Tight Budget

OK, so before we learn how to live on a tight budget we need to establish exactly where we are at in terms of our budget.

This quantification step is a key element of successfully living on a budget.

If we don’t know where the problem areas are how can we fix them?

1.1 Record Your Expenses

When my wife and I bought our first house our finances were spread pretty thinly.

We were both trainees with very modest salaries. We just managed to get a mortgage for a small, terraced house, 20 metres away from a motorway! And this was back in the days when lenders were quite happy to give 100% mortgages!

Consequently, most of our income went on servicing the mortgage. After utility costs, food costs, and travel to and from work costs, there wasn’t much money left at the end of the month.

In fact, there was so little money left that, in order to avoid accidentally slipping into an overdraft situation, we started keeping a handwritten cashbook to record all of our income and expenses. (Not that recording the income took very long!)

We recorded every expense. Even the really small items that were paid for in cash.

There were times when we had nothing left at the end of the month.

You should record every expense that you incur – the effectiveness of your plan to live on a budget depends on the accuracy of the information that you are using.

1.2 Complete a Budget

The way in which you choose to record your budget details is entirely up to you.

You could use:

- A pad of paper and a pen (ideally a pad with columns but you can always draw your own!)

- A dedicated cashbook (or even an old-fashioned ledger if they still exist!)

- A spreadsheet – if you want to go ‘old school’ you could print it out and write the figures in!

- A dedicated budgeting program/app

As I mentioned above, when we bought our first house we used a handwritten cashbook (that makes it sound grander than it was – it was actually just a pad of paper that we would draw vertical lines on to let us split out our expenses).

These days (yes, we still record our expenses to help keep us on the straight and narrow!) we use a spreadsheet.

I know that we are all pushed for time these days (and I’m one of those weird people that you’ve heard about that actually likes spreadsheets!) so I’ve put together an example budget spreadsheet that you can use.

Enter your email address below to sign-up for the Retiring Richie newsletter (there won’t be any spam emails and you can unsubscribe at any time) and get a link to the spreadsheet.

Then just go to the File menu, select the Download option, and then choose your desired file format.

OK, now that you’ve decided on the format that your budget will take its time to start entering the data. Fill in every relevant item for a whole month.

If you are using the downloaded spreadsheet then it’s the figures in blue font that you will be completing. Insert extra lines if you are confident using spreadsheets – otherwise, just add any unlisted items to an ‘Other’ category.

Once you’ve finished a full month you’ll be able to see your ‘Net Budget Outcome’:

- Positive figure (highlighted green)

Congratulations! You are earning more than you spend.

You are in the fortunate position of being able to decide what to do with the surplus – increase your pension contributions, add funds to a Stocks and Shares ISA, put the money in a savings account, or spend it. Or, of course, a combination of things.

Keep in mind that there may still be a benefit for you in continuing to follow this guide – you may be able to increase that surplus! - Negative figure (highlighted red)

Sorry! You are spending more than you earn.

Left unchecked you are going to get further and further into debt in order to meet these excess expenses (unless, of course, the excess is being met by accumulated savings – in which case, well done you!).

Keep reading to see what can be done to avoid this …

1.3 Categorise and Prioritise Your Costs

You’ll notice in the Retiring Richie Budget Summary that there are columns for categorising your expenses as one of the following:

- Essential

- Desirable

- Luxury

Making this allocation helps us to visualise what we must have, what it is useful to have, and what non-essentials we might enjoy from time to time.

In order to embrace living on a tight budget, you need to honestly evaluate your needs versus your wants.

Water is a need – the latest iPhone is not!

1.3.1 Essential Expenses

In terms of what is considered essential in order to survive the key items, in order and often referred to as ‘The Rule of Three‘ (you’ll see why), are:

- Oxygen

We can only survive for 3 minutes without oxygen.

Fortunately, nobody has yet figured out a way to charge us for this! - Shelter

In extreme conditions, we can only survive 3 hours without shelter.

Shelter includes not only having a building in which to live but also being able to heat it. - Water

We can survive for 3 days without water.

The key use is obviously for drinking but it is also necessary for sanitary purposes. - Food

We can survive for 3 weeks without food.

Our bodies need fuel in order to function – and that comes from our food.

So, for the purposes of our plan for budget living, our essential items include our housing costs and the cost of utilities (water, electricity, and gas).

We can still look to reduce the cost of these items but we can’t do without them.

1.3.2 Desirable Expenses

These are the items that are ‘nice to have’.

Not essential but they certainly make life a lot easier.

You may find scope for reducing these costs, which is great, but the easy initial wins are likely to come from careful scrutiny of the items in the next category.

1.3.3 Luxury Expenses

OK, these are the things that we could/should consider getting rid of in an initial purge.

It’s amazing how many costs we accumulate and then never make full use of the thing it is that we are paying for:

- Gym membership that we took out as a New Years’ resolution, used until February, and have never been back!

- Netflix subscription that we took out to watch Stranger Things and then never cancelled it.

- Eating out and takeaways because, well, work was tough and we don’t have anything in the fridge. Monday night Chinese takeaway, Wednesday night Pizza, Friday night Fish & Chips, Sunday Roast at the local pub. It all mounts up.

- Smoking. The average smoker has 20 cigarettes a day. At an average of £12.71 per pack – that equates to nearly £400 per month!!

We’ll look at cost-cutting in section 3 … but the above seem like prime targets!

2. Increasing Income

There are 2 ways of reducing a budget deficit; increasing income or reducing expenses. Let’s look at each in turn.

2.1 Gizza Job

Depending on your age (or how much old TV content you watch) you may remember a character called Yosser Hughes in the TV drama “Boys from the Blackstuff“.

The programme was set in the UK during the early 1980s – a period of mass unemployment. Yosser, unemployed and desperate for work, would often badger people by saying “Gizza job! Go on, I could do that. Gizza job.“

Fortunately, we have very low rates of unemployment in the UK at the moment. Many employers are crying out for extra staff but can’t source them.

Could you:

- Swap benefits for a job

- Swap an existing job for one that pays better

- Consider an additional job (perhaps a weekend job at a supermarket)

2.2 Other Income Sources

OK, so the job option doesn’t work for you – what else can you do?

What skills and assets do you have that others would be willing to pay for?

Who might give you money – for free?

- Parking

Do you have spare room on your drive? Are you in an area where commuters would like to be able to park? That could be an easy £5 per day (or whatever you decide to charge). - Rent-a-room

Similarly, do you have a spare room in your house that you could rent out? This can be particularly attractive as there is tax relief available (Rent-a-room relief) meaning that a large chunk of such income will escape the clutches of the taxman. - Change banks

Do a little research – you’ll often find that a bank is willing to pay you to move your account to them. Typical amounts are around the £100+ mark. It won’t make you rich but hey, it all helps. For example, the Nationwide Flexaccount offers £100. - Flog it

Get rid of unwanted items and get paid – win-win! Consider these:

– eBay – general sales (you’d be amazed at what people will buy)

– Gumtree – general sales

– Shpock – general sales

– Etsy – craft-based

– Vinted – clothes and accessories

– WeBuyBooks – guess!

– CEX – DVDs, CDs, games

– MusicMagpie – CDs, DVDs, games, mobile phones, and even Lego!

– Preloved – clothes (including wedding dresses) and accessories

– Car boot and jumble sales (check your local paper) – anything

– SellMyMobile – guess again! - Pay rise

Employees are in high demand at the moment. So, consider asking for a raise. Pick your moment and give some thought to what you will say. Don’t say “I need more money!” – tell your boss why you deserve more money. What value do you bring? How much would it cost to replace you? - Benefits

Are you claiming everything that you are entitled to? Try using a benefits calculator.

3. Reducing Expenses

When looking to live on a tight budget we need to embrace frugal living.

3.1 Ditch the Luxuries

Let’s start by revisiting our budget. Specifically the allocation between the essential, desirable, and luxury categories.

If you look at the picture of the spreadsheet that I posted in the ‘Complete a Budget’ section you’ll notice 2 things:

- Monthly expenses exceed monthly income by £504

- Luxury expenses amount to £564

So, if we were to ditch all of the luxury items we could change that deficit to a surplus.

Coincidence?

Of course not. I picked the figures to illustrate a point:

If you are spending what you don’t have, you are putting yourself into debt. That is not a sustainable situation, in the long run, so you need to make changes. One of the easiest changes is to cut back on luxury spending.

I know what you are thinking … don’t go back and move those items into the desirable category!

Give some serious thought as to which of these expenses you can easily do without (even if it’s just for a while until your circumstances change).

For example, could you:

- Quit smoking (or reduce the amount that you smoke)

- Reduce the frequency of having takeaways

- Cancel your gym membership and workout at home

- Cancel unused TV subscriptions

3.2 Dirty Word 1: Debt

We don’t like to talk about debt, do we?

Which is silly, because there is lots of help available if you just ask.

Not all debt is necessarily bad. For example, most of us will need some form of mortgage to buy a house. Or a hire purchase agreement to buy a car. However, these debt arrangements are typically for fairly low rates of interest.

The sort of debt that can quickly sabotage your budgeting efforts is that which has higher rates of interest.

The average credit card rate of interest is around 21%. More expensive cards can be double this (or more)! These rates become particularly damaging if you allow them to start compounding – for example, if you just make minimum payments on your cards.

If you have a budget deficit then clearing debt is likely to be one of the most important things that you can focus on – both financially and in terms of your mental health.

Focus on clearing the debt with the highest interest rate first, then the next highest, and so on until you have cleared all bad debt.

Possibilities for cutting the cost of your debt:

- Check your credit rating

If you are going to look at rearranging debt (see below) then the first thing to do is to check your credit reference information – faulty information could cause a lot of problems, so check first.

What’s better than getting something for free? Being paid for getting it!

In the Cashback section, you’ll find links for both Topcashback and Quidco. Sign up with Clearscore (giving you free access to monthly Equifax credit reports) through these sites and you’ll actually earn cashback for doing so.

Similarly, through Topcashback you can sign up with Credit Karma to get free access to your TransUnion credit report. Again, you’ll earn cashback for doing this. - Find a better credit card deal

OK, so the reason that you checked your credit rating was so that you can look for opportunities to reduce the interest rate charged on your credit card debt. Obviously, you are going to be able to clear the debt more quickly on a card that charges 10% interest compared to one that charges 30%!

You should do your own research but you may well be able to find a 0% interest card – note that in most cases this only applies to the balance transferred, not to additional purchases (so don’t use this card for purchases). Note also, that some cards may charge a transfer fee.

When the 0% interest period ends – look to transfer to another deal (assuming that you haven’t yet repaid all of the debt).

At the time of writing, a potential card for you to consider would be the one from Sainsbury’s Bank that offers 34 months at 0% for balance transfers (with a fee of 2.88% or 3.88% depending on circumstances). - Find a better mortgage deal

For many of us, this is the biggest monthly expense – so it is a huge benefit if we can reduce it. This will heavily depend on your circumstances but if you have plenty of equity in your house then your chances are good.

Start by seeing whether your current lender has any better offers. Then have a look at what else is available from other lenders. Remember to check for any extra costs like early redemption penalties if you change lenders. - Use savings to repay debt

The interest rate given on your savings will nearly always be lower than the interest charged on your borrowing. Therefore, it makes financial sense to pay off the debt as far as possible.

If you’d like help in dealing with debt then you can try contacting the following:

3.3 Dirty Word 2: Haggle

And what do we dislike doing nearly as much as talking about debt?

That’s right, haggling!

In life, you don’t get what you deserve. You get what you negotiate. So don’t be afraid to ask – the worst you can hear is ‘no.’

Christine Tsai

When we get a renewal notice come through for a particular annual expense we tend to think that we just have to accept it. Well … we don’t!

It all comes down to how much you want the service – and how much the provider wants to keep your custom. It’s a power battle!

Typical candidates for this approach are firms like TV and broadband suppliers (eg Sky), private medical insurance providers (eg Saga), and roadside assistance providers (eg AA).

And the potential savings can be substantial!

A plan of action would be something like this:

- Make a note of the proposed renewal cost and what you get for that payment

- Look online to see what is offered to new customers of the supplier (it is often less) and note this down

- Then look to see what competitor suppliers offer

- Have an idea of what you want to achieve – price reduction, extra services, etc

- Call the supplier and say that the proposed cost doesn’t compare favourably with deals offered to new customers and deals from other providers and you are considering leaving. BE NICE!

- You will likely be put through to a special ‘retentions team’ – a collection of people whose job it is to persuade you not to leave!

- This is now your opportunity to see what they are prepared to offer. BE NICE!

- Don’t necessarily accept the first offer that is made

- Come to an agreement and ask them to confirm the details by email. And BE NICE!

Keep in mind that these individuals are just doing their job. You are far more likely to be successful in your negotiations if you … BE NICE!

Keep in mind that you may have to repeat the haggling process each year. That said, a 10-minute phone call once a year to save £100 or more is well worth the effort in my book.

3.4 Cashback – Why wouldn’t you want it?!

Cashback sites. You’ve probably seen them advertised and thought “That’s a good idea. I should do that.” but then you never do.

Well, you should!

Cashback sites provide free money when you buy goods or services. Why wouldn’t you want that?!

This can amount to £100s every year.

Here are some to consider:

- TopCashback

Yes, the one with the annoying chap in the TV ad! Don’t let that deter you, this site offers some great cashback deals with the likes of Amazon, John Lewis, M&S, Tesco and mots more. Use this referral link to earn some extra cash for both of us. - Quidco

Quidco has been around for years and offers cashback on lots of top brands like EE, Confused.com, Gousto, Nespresso and many more. And if you use this referral link then we’ll both get a small amount of cash just for you signing up and earning some cashback. - Swagbucks

This isn’t just a cashback site. You can also make money by completing surveys, watching videos, and searching the web. Now, don’t think that you’ll become a millionaire just by watching videos all day, the payments aren’t that high … but it all helps, right? If you use this referral link will both get extra Swagbucks!

Here are a few things to keep in mind with cashback sites:

- The money you get is a discount on the cost of the product rather than being seen as a source of income. Therefore, it is tax-free.

- There are no guarantees with these things – the prudent thing to do is to withdraw any cashback as soon as it is received. Don’t leave money just sitting in your cashback account.

3.5 Cutting Back – Taking an Axe to Costs

So, we’ve already hacked away at the luxury expenses identified in a budget recording.

What’s next?

3.5.1 Credit Cards Revisited

We’ve looked at credit card debt and transferring balances to low-interest alternatives.

But should you avoid credit cards altogether?

At the end of the day, credit cards are just tools that we use when buying things. They aren’t somehow inherently evil!

However, as with all tools, they need to be used correctly to get the best out of them – and they can be dangerous if not used correctly. So, what’s the correct way to use credit cards?

- Pay them off in full each month. Ideally, set up a direct debit instruction to do this automatically. We do not want to be paying interest charges.

- Get one that offers rewards to you (either in cashback or in points that can later be redeemed for something that you want).

- Don’t use them for cash withdrawals.

Potential candidates include the American Express Platinum Cashback Credit Card or the Lloyds Bank Cashback Credit Card. You could Google these terms and go directly to the sites concerned.

However, if you’ve been paying attention you should be thinking “Can I apply using a cashback site like Topcashback?”. Yes, you can! Why not get cashback two ways?!

3.5.2 Conserve Power and Water

As we discussed earlier, these items are essential expenses and we shouldn’t try to live without them. However, we can look at reducing our usage (and therefore the cost).

We should all look to have our thermostats set to the lowest level that is comfortable – this is best not only for reducing our costs and also for doing our bit to save the planet.

The Energy Saving Trust says that for most people this is between 18°C and 21°C. And the Committee on Climate Change recommends thermostats are set no higher than 19°C in the battle to combat global warming.

That said, care needs to be taken. Age UK recommends older people keep the rooms they use most at 21°C. If you are a pensioner make sure that you receive the Winter Fuel Payment from the government (it should be paid automatically if you are entitled but it’s worth checking).

Reducing the temperature on the thermostat by 1°C can save over £100 per year.

Other energy-saving methods include:

- Dry clothes outside on a clothesline or inside on a clothes horse rather than using expensive tumble driers

- Reduce your washing machine temperature from 40°C to 30°C

- Switch things off when you aren’t using them

- Where possible, cook with a microwave rather than an oven

In terms of saving water, consider things like:

- Having a shower instead of a bath

- Reducing the amount of time spent in the shower

- Not leaving the tap running when brushing your teeth

- Not running the dishwasher until it is full

3.5.3 Be a Savvy Shopper

- Do Your Research

Whenever you are buying something, do some research to identify where it is available for the least amount of money. Often the same product can be bought much cheaper at one retailer compared to another. - Look for Discounts / Vouchers

A simple 5-minute online search can often produce a discount code that you enter on the checkout screen and which saves you money. - Loyalty Schemes

Always take advantage of loyalty schemes from shops. Things like a Tesco Clubcard provide money-off vouchers and cheaper prices for certain products. - Shopping List

When you go to the supermarket have a shopping list and don’t deviate from it – avoid impulse buys like the chocolate bars teasing displayed where you have to stand to pay. - BOGOF

Buy One Get One Free and similar offers can be great money savers. There are 2 caveats here: Firstly, only buy it if you need it. Secondly, do some quick mental arithmetic to see if it really is cheaper than the alternatives (ie don’t always trust sneaky supermarket advertising!) - Cheaper Supermarkets

Consider a cheaper supermarket – the German retailers Aldi and Lidl are often much cheaper than their rivals and the quality of their produce is excellent (just be wary of the ‘Aisle of Wonder’ offers that may tempt you!) - Own-brand products

Consider own-brand products rather than the more expensive big-name versions – in taste tests most people can’t tell the difference! This change alone could save £100s per year. - Second-hand items

Does your purchase have to be new? Would a used version be acceptable? (it will certainly be cheaper). This is especially true with clothes, furniture, household appliances, and, of course, cars.

3.5.4 Be a Careful Cook

- Cook at home rather than getting a takeaway or eating out as it will invariably be cheaper

- Are you a 2-person family unit and get fed up with recipes for 4 or 6 people? Cook them anyway and freeze the surplus to eat another day.

- Make purchases spread over more than one meal. If you have a roast dinner and have leftovers – save them, don’t bin them! Make another meal from them the next day. And sandwiches the day after that.

- Change the balance of your meals. Buy less of the expensive ingredients and more of the cheaper ones. Less meat and more vegetables, pasta, or rice will be better for your pocket, better for your health, and better for the planet.

- When you do have meat, look for cheaper cuts. Cooked correctly these are often even tastier than their expensive counterparts.

3.5.5 Frugal Fun

Learning how to live on a tight budget doesn’t mean that enjoying yourself isn’t possible. In fact, it is very important – budget living is much easier if you can still have fun.

So, what frugal fun activities can you enjoy?

- Public areas like parks

Weather permitting (we always have that caveat in the UK, don’t we?) there are many parks and nature trails that can be enjoyed with a leisurely walk. There is even a government website to help you find them.

Plan ahead and take bottled drinks and low-cost snacks with you so that you aren’t tempted by expensive vendors. - Local events

Keep an eye on the features in free local papers and in social media. These often provide information concerning free concerts and other events that are local (to minimise the cost of travel).

If you have spare time, see whether there are paid-for events that are looking for volunteers to help out in return for free entry.

As with the parks, go prepared with food and drink to avoid the costly on-site vendors. - Volunteering

Why not enjoy yourself while helping somebody out at the same time? Can you spare some time to walk some of the dogs at a local animal rescue centre, or spend time with the cats? Not only can this be enjoyable but it can also be good for your health. - Library

Yes, good old-fashioned libraries still exist. And they still provide books for you to read, free of charge. New books can be quite pricey these days so why not consider a no-cost alternative? - Learn a new skill

Why not teach yourself something that you find interesting? Or something that could save you money, like DIY skills. There is lots of information freely available online or, again, at your local library. - TV

Yes, there is a multitude of subscription-based TV entertainment packages. However, there are still free options (although don’t forget your TV licence).

Freeview provides around 130 different channels. Enter your postcode in the Freeview Checker to see what is available in your area. - Offers

For those times when you do want to go somewhere that has a cost associated – look for offers like 2-for-1 deals before you go.

3.5.6 Odds and Ends

Some further tips for how to live on a budget:

- Coffee cash drain

I love coffee. I would be hard-pushed to give it up and I wouldn’t ask you to either. However, I don’t buy expensive takeaway coffee. There are variations, of course, but the likes of Costa, Starbucks, and Caffe Nero typically charge around £3 for a coffee.

If you buy one of these every day on the way to work then that’s roughly £720 (£3 per coffee x 5 days per week x 48 weeks per year) per annum. £720!!! On coffee!

Buy a thermos flask and take your own to work! Or just make a coffee at work. - Sandwich savings

Similarly, if you buy sandwiches for work each day this works out far more expensive than making your own. - Self-restraint

If you don’t have money budgeted for something – don’t buy it! You are responsible for your financial decisions. - Car costs

Running a car is expensive. Especially with the recent increase in the cost of fuel. So, can you reduce your costs by walking or cycling, car-sharing, or using public transport? - DIY

Are there things that you could do yourself rather than paying a tradesman? Sure it takes up some of your own time and may (or may not!) produce a poorer end result but it can save large amounts of money. There are YouTube guides for pretty much everything these days. - Cupboard and Fridge raiding

Ever find that you have out-of-date items that need to be thrown away? What a waste! Periodically, have a look through your cupboards and fridge (and freezer) and use up things before they go off.

4. Budget Planning

We’ve looked at our historical cost budget (what we are currently spending), we’ve looked at areas where we might earn more money, and areas where we might reduce costs.

Now it’s time to draft a forward-looking budget, showing the income and expenses that we plan to have going forward.

Is it now in credit? If not, you may need to repeat the process above to see what else can be done.

If it is now in credit, you need to make sure that you stick with it and use any surplus to clear off any debt. Know how much you have available to spend in each area and do not exceed that amount.

Where possible, pay for things by direct debit (this often is cheaper). This automated process removes any temptation to spend money earmarked for essentials on luxury items.

What we did (and still do) was:

- Look at the annual cost for essentials and those desirable costs that we wish to keep (primarily car costs)

- Divide that total by 12 to get the monthly cost

- Set up a second bank account (we imaginatively call ours the ‘Number 2 account’!)

- Transfer, by standing order, the monthly cost from your Current account to the Number 2 account

- Set up direct debit instructions from the Number 2 account – water, council tax, gas, electric, car tax, car insurance.

- Do not use the funds in the Number 2 account for anything other than the costs it is intended for

4.1 Building a Buffer

Having arrived at a position where you are now in credit it would be prudent to take steps to avoid any potential difficulties in the future.

This takes 2 forms:

- Savings

Savings can be a useful lifeline for unexpected costs. Use your planning budget to see how much you can comfortably put away each month – use a direct debit to avoid the temptation to spend the funds designated for savings. - Pension

How will you meet your costs in retirement? Can you afford to retire?

The sooner that you start saving into a pension, the more comfortable your retirement will be. It’s as simple as that. As soon as you are able to do so this should be a priority.

5. FAQ

How do you live on a tight budget?

- Establish your position by preparing a budget summary (a spreadsheet is easiest)

- Identify potential sources of additional income

- Eliminate or reduce costs. Identify costs which can be cut without having a major impact on your life, eg gym membership when you no longer go, TV subscriptions that you no longer watch etc.

- Clear debt. Some debt, like credit cards, has a high rate of interest which makes it costly – focus on clearing these as quickly as possible.

How do you eat well on a tight budget?

Eating healthily is not necessarily more expensive than eating unhealthily – in fact, it is usually quite the opposite.

Focus on changing the balance of your meals. Rather than having a large amount made up of meat or fish (which are expensive), look to have more of the cheaper ingredients like vegetables, pasta, and rice.

When you do buy meat look for the cheaper options – pig’s liver rather than a rack of lamb. And when you buy fish, consider tinned rather than fresh – tinned oily fish like mackerel are a great option.

Avoid waste. Don’t leave food in the fridge or cupboard until it goes off. Do try to get more than one meal from ingredients, for example, a Sunday roast and then Bubble & Squeak on Monday to use up any leftovers.

How do I stop being broke?

Make a budget to identify where the problem lies and then take steps to tackle it.

Most of us have expenses that are more ‘want’ than ‘need’ – cutting these out can make a huge difference. Cigarettes, takeaway meals, takeaway coffees, TV subscriptions, mobile phones, gambling – all of these we can live without.

How do you have fun on a tight budget?

It’s important to still have fun when you are on a tight budget – it helps to maintain your mental health.

Look for parks and nature trails that are free to use where you can take peaceful walks and enjoy your surroundings. The exercise itself will help you to feel better too.

Consider volunteering. Helping out at an animal rescue centre, for example, would be a great help to that organisation and would also be an enjoyable experience for you – walking a waggie-tailed dog who will soon consider you to be the highlight of his day, or petting an old tabby cat that has been starved of attention since her owner died.

And for something more relaxing, there are many free TV channels available through Freeview or you could read a book from your local library.

6. Conclusion

OK, that’s it. I hope that this post has given you some guidance on how to live on a tight budget.

If you skipped over the spreadsheet download section so that you could continue reading, here is another chance to grab your free copy:

Finally, if you have any tips that you think would be helpful to others, do please add them in the ‘Comments‘ below and I’ll look at adding them to the article.

These are great tips to live on a tight budget. I like to record my outcome and income every month, it definitely allows me to keep track of my money! x

Lucy | http://www.lucymary.co.uk

Hi Lucy, thank you for your positive feedback.

What an informative blog! This is important now everyone should have financial literacy. Thanks for sharing!

Thanks very much, I’m glad that you enjoyed the post.

I don’t like the debt idea and I try my best to stay out of it. These are great tips!

Thanks for your feedback, much appreciated. Yes, avoiding debt is something that we should all aspire to.

Great post Richie! This was very informative and has inspired me to keep a record of my expenses. Using credit cards and cash can get out of hand very fast, especially when you’re not tracking it. Having a visual helps a ton. Using cash back sites, looking for deals, and planning ahead are great ways to save and spend less. Thank you for sharing, this was very helpful!

Thank you. When I wrote this post I thought that if it helped one person then it was worth it – I’m glad that you have been inspired. Good luck with your budgeting.

I’ve recorded my income and outgoings ever since I was a student – it’s amazing how things add up when you don’t realise what you’re spending. And having a side hustle (my blog) has definitely helped in recent years, as has putting money aside for an emergency fund. Good tips, Richie, thank you for sharing!

Hi Lisa, thanks for your comment. Yes, it’s not always the big ticket items that lead to problems but rather the smaller, frequent items that we dismiss as not important.

Very helpful tips, pretty detailed post and definitely, I know the feeling..

Thank you, I’m glad that you found the post helpful.